Paying off Student Loans Early: A Good Idea?

If you have student loan debt and are making the minimum monthly payments, you may have considered paying off student loans early by making even more payments each month. In fact, doing so is part of the strategy we recommend for people who are pursuing the best way to pay off student loans. There seem to be some “mixed reviews,” however, about this topic as many people disagree.

Sometimes you hear the argument that “it’s better to save for retirement and just make the minimum payments on your student loans” or that “student loan interest rates are already pretty low, so worry about them later.” Today, we are going to make the case for paying off student loans early and explain how it can be an incredibly smart financial decision. Essentially, paying off student loans early boils down to two main benefits:

- It can save you thousands in interest.

- It can create stability in an unstable economy.

Saving on Interest

Any time you are dealing with interest rates, you are dealing with growing costs. In other words, the longer it goes unpaid, the more you will have to pay. So as a rule, paying off the interest saves money over time, even when the interest is relatively low.

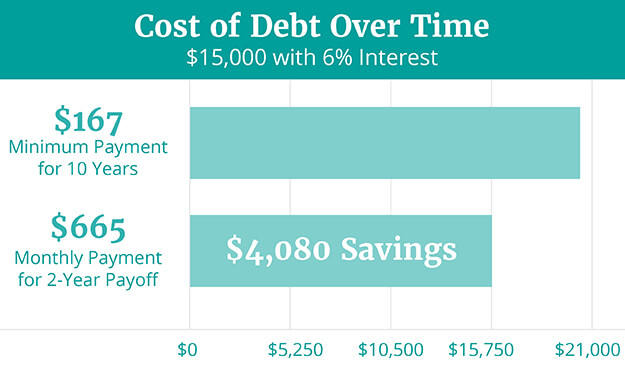

Let’s take a look at an example of how much can be saved by paying off student loans early:

The interest rate in this example is 6%, slightly less than the Stafford rate of 6.8%. As you can see, a two-year repayment saved $4,080. Of course, the borrower was making a hefty monthly payment of $665. This won’t be possible for everyone.

So let’s consider a more reasonable example: If a borrower could make a monthly payment of $289.99, the debt would be gone in five years. This isn’t quite as extreme as a two-year payoff but still allows the borrower to “get ahead.”

Not only is it nice to have a shorter repayment, but the interest savings are nice too. A borrower who pays $289.99 and finishes in 5 years will pay $2,399.54 in interest alone, but he or she will still be saving $2,584.18 compared to the 10-year repayment plan.

Don’t think this is possible for you? Look for ways to save money on groceries, going out to eat, housing, entertainment, and transportation costs. You might be surprised to see how much extra money you could put toward your student loans.

Creating Stability

The second primary benefit of paying off student loans early is that it creates stability. Having a job is a great thing in today’s economy, but with uncertainty ahead, consumers should not take their employment and income for granted. It could be financially foolish to only make your minimum student loans payments because you assume you will keep your job.

A better strategy would be to prepare for unemployment in order to protect yourself. Do this with an emergency fund, as Jerry Cruthis explains:

Once you have established your emergency fund, there is really no reason not to start paying off student loans early. That’s because you already have a cushion that will keep you covered if you were to lose your job or experience another unforeseen expense.

Paying Off Student Loans Early is a Counter-Cultural Decision

Let’s face it, many people out there don’t even have the option of paying off student loans early due to poor job prospects or other types of debt. If you are able to even consider this as an option, you are pretty lucky.

The problem is, most people in this position don’t realize how lucky they are! They don’t see the real opportunity that has presented itself. In essence, paying off student loans early is a counter-cultural decision, because very few people are doing it or encouraging it!

If you are able, we challenge you to pay off your student loans as soon as you can. Of course, saving for retirement along the way is a good idea, and you’re going to want to establish a solid emergency fund. But in the end, paying off student loans early will save you in interest and put you on solid financial ground, regardless of your employment situation. It may even open up new opportunities for you, since you won’t be burdened by the debt. In a few years, you might look back and be very happy with your decision to pay off the debt early.

For those of you who might still be struggling and aren’t in a position to get ahead on payments right now, that’s okay too. Our student loan counselors can talk to you about your best option moving forward. Learn more about our student loan counseling today!

What are your thoughts about paying off student loans early? Let us know in the comments below.

Juana

Hello,

I had taken out a FAFSA loan of around $5,000 for school, but recently I inherited around $8,000 which will be a big help for school. Is there any way I can simply pay the whole amount I borrowed from FAFSA? Since I qualified based on need I pay little or no interest. Thanks

Thomas Bright

Yes, you can certainly pay off the loans (federal loans won’t have any sort of prepayment penalty). If they are subsidized loans and not accruing any interest, then you might wait until your grace period is over.

Bella

To clarify: I did not pay any interest on the loan that I just paid off. I am still in school, so I guess the interest doesn’t apply until after my grace period? my loan is unsubsidised. I’m just afraid that I missed something I should have paid and it will come due without me realizing it and ruin my credit. Sorry if that is confusing

Sara

Hi, What happens if I pay off the interest rate on a loan while I am still in college? Would that be beneficial or hurtful?

Thomas Bright

Since student loans grow every day, this can help minimize the total cost of the loan.

sant

My son’s mother wants to pay-off a substantial portion of his student loans especially unsubstitized. Is there any possibility of getting a discount? They are about four years old and he has been paying the bear minimum.

Thomas Bright

If you have been making timely payments, it’s unlikely that the lender will agree to a lump sum settlement. It certainly can’t hurt to ask, but they will likely say no. There may be a slightly increased likelihood if these are private instead of federal.

Lindsey

My husband and I made every effort to pay off my loans for graduate school as quickly as possible (and did in less than a year after I graduated). However, I just recently was made aware of a loan-forgiveness program which would have forgiven $17,500 of student loan debt (I have worked in a low-income school for the six years since I graduated and I am classified as “highly-qualified”). If we had known this was a possibility, we would not have sacrificed so much to get my federal loans paid off so quickly. Now, because we paid them off early we are unable to get the forgiveness benefit, which seems like punishment for eliminating debt quickly. Is there anyway to get this forgiveness even if the loan has already been paid off? Retroactive reimbursement or something? Thanks for any help.

Thomas Bright

Hi Lindsey,

Generally programs like that still require you to make monthly payments. It’s just that if there is debt remaining after the 10 years, it’s forgiven. So you may have still made the right choice, getting it all out of the way now instead of dragging out payments for 10 years. There are some programs, usually varied by school, that might allow you to literally pay nothing toward your loans if you are under a certain income threshold. Maybe that’s how your program worked. I’m not sure that they would approve a retroactive arrangement, but that question would be best directed to them directly.

Best of luck!

Renee

Based on one set of life circumstances, I chose the graduated, extended repayment program on my federal student loans. My life circumstances have changed. I am interested in making additional payments each month, however, I would like to have an idea on what type of impact extra payments would make. One frustration I have is that my servicer, Ed Financial Services, does not have a repayment calculator that is designed specifically for graduated, extended repayment loans. Do you have any suggestions on how best to make extra payments. My understanding is that making extra payments is all about timing of the month, as interest builds daily. I would like to clarify that any extra payments I make, I would prefer to go to the principal balance, and not interest. Thank you for any suggestions you may have.

Thomas Bright

Hi Renee,

Great to hear that you can pay more toward your loans. I’m not immediately sure how the calculations would work here. My understanding is that payments increase every two years, based on a 10-yr total payment (excluding consolidation and FFEL loans). So by paying them down early, my guess is that the increases will be to a lower amount than they would be if you didn’t make extra payments, but I see why that’s tough to figure out exactly, and without a handy calculator.

My suggestion is to call Ed Financial directly to ask, and also to check out this post, which dives into the details about how to maximize interest savings.

Gloria Curtis

Can they take your tax refund if your not making the required monthly payments? I can only make $50.00 a month.

Thomas Bright

Yes, that is possible once garnishments begin. I’m not sure if you’re referring to a federal or private loan. If federal, I’d recommend contacting your servicer about an income-based repayment option. If private, this may be less likely, but you should call them to talk through your options if you haven’t already. A student loan counselor here at Clearpoint can also help explain the options available to you.

Jim Darling

Hi Tom, quick question:

I’m on PAYE, my monthly minimum required payment is less than my monthly accrued interest, and I have multiple federal loans with accrued, noncapitalized interest. I want to target payment at my highest interest rate loans. Do I have to pay off all of the interest on all of my loans before I can pay down principal on the one I want to target?

Thanks

Thomas Bright

Jim, I *think that you can pay toward the principal of a loan even if other loans have outstanding accrued interest. Now, you will need to pay off the accrued interest on the loan you are paying on. So if you want to pay loan A but it has $200 in interest, you will have to pay off that $200 before you can pay down Loan A’s principal. But if you also had Loan B, which had outstanding interest, I don’t believe that would prevent you from paying the principal on Loan A. I definitely recommend calling your service to ask them this question directly and make sure you understand how to submit this type of payment to them. Good luck!

Jennifer

Hi Tom,

So I am about 45K. Graduated in 2007 and due to financial hardships I am currently on a IBR plan. My last employment lasted about 5 months and was paying 160.00 per month as steady income coming in. Now unemployed again due to no fault of my own just only get in my seat for a couple of month jobs. My IBR with my salary is 42.00 per month. My question is that with my next job I would still like to pay 160.00 per Month. Also save around 2 amounts of $5,000 and invest in a CD of some sort. So I will be paying more than my IBR and also save towards the principle. Does this sound wise as am wanting to pay off at least 20,000K in the next two years. The only problem is job stability which has been shakey for me from the Recession of 2008.

Thomas Bright

Hi Jennifer,

It’s always great to minimize interest and your total payoff amount. One thing to keep in mind is that rates on CDs are pretty low, and the rate on your student loan is probably higher. In other words, it may make more sense to pay down the loans as that money becomes available, rather than saving it to pay later (because later, the debt will be more expensive due to interest). That said, it could be a good idea to save for other goals, and you might incorporate that into your plan. That’s one great perk about IBR–that you can contribute to other financial goals and not stay swamped down in your student loans.

Kim

Hello,

I currently have about $5,500 in student loan debt and I have the capability to pay off the balance in full. Is there any way that they may offer me a discount of any kind for erasing my total debt? My loans are not in deferment nor are they in a collector’s hands. What do you think regarding paying off the total amount?

Thanks!

Thomas Bright

Personally, I like the idea. Some financial gurus will point out that if your interest rate is low you can end up better off by investing the money and just paying the minimum payment on your loans (they anticipate that the market will return a higher rate than the loan is costing you). That said, the peace of mind and stability that come with paying off your student loans are totally worth it, so I think this is a great way to proceed. It just depends on your personal situation and goals. Best of luck!

John

Good Morning Thomas!

I was wondering how paying off your entire college loans in one lump sum would affect your credit score? I know that the age of your credit account has about a 15% effect on your total credit score. Would paying off the entire lump sum remove that account from your credit score? I’m assuming it would. Which would remove one account that I have had for almost 5 years. Just as a reference, I have 3 credit accounts:

-2 that are 4 years and 3 months

-1 that is 1 year and 9 months

Any help you could provide would be great!

Thanks!

Thomas Bright

John,

This is a great and important question. Let me give a few qualifiers… the main reason you might not want to pay off student loan debt in a lump sum like this is because that money might work more effectively for you somewhere else (in other words, you might get a better return on retirement savings or other investments than the interest rate on the student loans is costing you). So just be aware of that perspective, which lots of folks adopt.

THAT SAID, I’m all for the security and peace of mind that come with paying off debt, including student loans, and I think paying off with a lump sum can be a great idea. You’ll be happy to know that you won’t need to worry too much about your credit taking a hit. Even when you pay off the loans, they will contribute to your credit (and remain on your report) for up to 10 years from your last activity. This means you shouldn’t need to worry about the age of your accounts taking a hit.

Most experts seem to think there is a slight benefit to keeping the loans open longer, but that doesn’t mean the benefit outweighs the rewards of paying off the debt early. In fact, they almost certainly don’t. The long story short is this: you shouldn’t have to worry about a decrease to your score just from paying these off. The score may not go up as much as it would if you left them open longer, but in most cases that’s not enough of a reason to let interest accrue and cost you more money over time.

Hope this makes sense and is helpful!

Ashley

Hi Thomas,

Reading through your article and your responses to other people’s questions has been quite helpful! I was hoping you might be able to help me gain a better grasp of my own student loan situation. I attended graduate school and graduated in May 2013. My current loans are:

-Direct Sub Stafford- $8,611.93 @6.5%

-Direct Unsub Stafford- $29,443.74 @6.5%

-Direct Unsub Stafford- $35,325.97 @6.5%

Total Debt: $75,923.81

I am currently on the Pay as You Earn repayment plan and my monthly payment is $138. I recently received a raise, and I just checked with my loan servicer and my payments will be going up to $240 starting January 1, 2016, and based on the repayment calculators the following year my payments will be $350.

My questions are:

1. Would you suggest paying extra each month even though I am on the Pay as You Earn plan, or should I just ride out the 20 years and hope some is forgiven? If I should be paying extra, how much would you suggest paying each month?

2. Is there a point at which I can be “kicked-out” of the Pay as You Earn plan if my salary gets too high?

Any advice you may have would be greatly appreciated!

Thanks!

Thomas Bright

Hi Ashley,

Great questions. I think you asked this on another post of ours too. You may have missed my answer, so I’m re-posting it here:

These are great questions. Only you can choose how to move forward, but here is the big thing that jumps out to me. I’m all for paying off student loans as quickly as possible, but you also likely want to be working toward your other goals, like saving for retirement. It sounds like you have a nice job, that’s on the “up and up,” and so maybe it would make since to stay on the PAYE program so you can have a balanced strategy (working on your loans, but also saving). Sure, you could pay more on the loans each month to offset the interest, but don’t stretch yourself too thin.

That said, I’m not entirely sure about how the conditions of the program change as your income increases (I need to do some more research on this myself). I think the idea is that the plan makes sense if it gets you a lower payment than the standard 10 year repayment. I’m not sure at which point your salary would demand a payment equal to that of a 10-year plan, but until then it might make sense to stay on board the PAYE program.

Best of luck to you!

Steve

Hi Tom,

I’m an Engineer working in California with a pretty decent salary (before taxes). I graduated in 2011 with a Dual Bachelor’s and $100K worth of student loans which is now down to around $87K. I have zero credit card debt, $16K worth of rainy day or house down payment funds, and $30K in my 401K (which I haven’t rolled over from my previous company yet. I will in the future since my new company matches as well).

Here’s a breakdown of my student loans:

Private – ( $6,800 at 9%, $20K at 5%, $22K at 9%) – $385/mo

Fed – ($14K, broken up into 4 small loans ranging from 2% to 6%) – $119/mo

Private – ($10K, INTEREST FREE) – $250/MONTH!

After rent, car payment/ins, cell phone, gas, entertainment, I have about $500 extra per month to contribute towards my loans. I’ve been following the Dave Ramsey snowball plan somewhat but I’m kinda torn on how to proceed. Should I use any of my savings to pay off some of the smaller loans and free up more monthly income, or just keep my rainy day fund and continue to contribute $500/mo and income tax money to become debt free. The payment of $385 per month isn’t even touching the principal and I would love to free up $250 per month by paying off the $10K private loan but its interest free. I just want to be debt free asap! I’m tired of my student loans sucking up $800 + per month. As you can see, I may need to seek a financial counselor since my situation is rather complex but any advice would help. 🙂

Your thoughts?

Thomas Bright

Hey Steve,

These are some great questions–thanks for sharing your specifics! And great job on saving for retirement–you’re off to an impressive start.

Have you by chance read our piece on The most efficient way to pay off student loan debt: https://www.clearpoint.org/blog/best-way-to-pay-off-student-loans/?

It’s worth a read, but here’s the short scoop. I’m not a huge fan of using the snowball method for student loans. The whole advantage of snowballing is to keep a psychological edge, which works well with small credit accounts. but, it’s largely inefficient and therefore not a good solution to loans that are already big (like student loans).

I think putting your extra income toward loans is very smart considering you have a cushion and are contributing to retirement. If you do so, I suggest ranking your loans in order of interest rate–and paying all your extra to the highest interest account until it’s paid off. Pay the minimum to everything else.

Best of luck–and let me know if you have other questions (hope you’ll check out the longer article).

-Thomas

Phil

In my situation I have 33k in loans and an ICR payment of 140 a month. So over the course of 25 years it would take to get to the point where the remainder of the loan is forgiven, i would have paid a total of 42k back plus whatever the taxes would be on the forgiven loan (that could be substantial). So I would have to pay it off in under 10 years to come in under the 42k. So those payments would then be roughly 355 a month. So if i cannot get it paid off in that 10 years then it behooves me to just pay the minimum as I would actually pay back less over the life of the loan.

Any thoughts on this? And can you tell me if I am missing something in my calculations?

Thomas Bright

Phil,

I think I follow what you’re saying. These situations are always a bit tricky. You’re right that there are drawbacks to using the forgiveness plan (tax implications and a higher total repayment), but there are also drawbacks to paying early (a big monthly payment). I guess for me, it depends how quickly you can pay it down. If you can aggressively pay it down and then start working toward a more balanced budget (saving for retirement, etc.) then it might make sense to do that. If not, and you’re only going to barely come in under 42K, then you may be better off taking advantage of the low ICR payment and trying to utilize other strategies (like saving for retirement) with the extra money you aren’t having to put toward the loan.

Catherine

To anyone that can help me,

I’m currently in school and will be a senior this fall. Due to incredibly lucky circumstances, I will be inheriting enough money to pay off my student loans from my soon to be husband. I have some concerns about paying off the loan outright before the first payment is due. How will it effect the money being lent from my loan provider when the costs will be covered? Will there be penalties or additional charges? Since I am not married yet, this would be kind of like a third party involvement. You could even label it as winning the lotto…No matter what, how does this effect my tuition?

Please reply to this if you have some valid insight to this situation. Thanks in advance!

Thomas Bright

Hi Catherine,

Wow, you are lucky! That’s certainly a great position to be in. Here are my initial thoughts/advice and things you’ll want to look into more:

-Are any of your loans gaining interest currently? If not, there’s no pressure to pay them until they start accruing interest, six months after graduation in most cases for subsidized federal loans.

-Are you aware of tax implications? If you do this before you are married, and the amount exceeds what the IRS considers a “gift,” you may have some tax considerations. I’d research this if you haven’t already and potentially consult with a tax professional.

-I’ve never heard of pre-payment penalties for student loans, and they absolutely don’t exists for federal loans. If yours are private, you may want to touch base with the lender just to double check.

-This shouldn’t effect your tuition in any way.

-Depending on the specifics of your financial situation, just consider other options for part of this money. Do you have an emergency savings and will you be able to contribute consistent funds to retirement? Those are two other uses for this money if you decide to use some of it that way. Just a thought–and lots of people who are financially stable like to potential to earn more on investments than they lose in student loan interest.

Overall, it sounds like you are in a very good position, and it’s great that you are being financially responsible and thinking “pay debt first.” Congrats, and best of luck!

Krys

Hi Thomas,

My first year in my 2 year nursing program my loans as follows:

Subsidized Stafford: $1750/3.86%

Unsubsidized Stafford: $3000/3.86%

2nd year:

Sub: $4500/4.66%

Unsub: 3000/4.66%

I never had a credit card due to the fact that when I was 18 I was put into collections for medical billing (I’m 26 now). I paid off that debt months later.

So here’s my question, because of the fact that my credit is basically terrible, should I pay monthly payments or can I pay off one of the loans in full? What I really want to do and can do is pay off both unsubsidized loans and be done with them. I’m still in grace until December 20. I just graduated and I’m hoping to be hired as an RN by then.

Thomas Bright

Hi Krys,

This is an excellent question. There is some evidence that by just making the monthly payments and extending the payment period, you could add slightly more benefit to your credit score than if you paid off the loan in full. But I think there is much more to consider here. Sure, credit scores are important, but so is saving money. If you are able to pay off the loans you will save a nice chunk of money that you would otherwise have to pay toward interest. The money you save can help you create an emergency fund, save for a down payment on a house, save for retirement or work toward some other financial goal. In many cases, that is worth a lot more than a *potential* credit score lift. There are other ways to build your credit, too. Scoring models are starting to be more forgiving in regards to medical debt for one thing, and for another–that collections account will be off of your credit report very soon. I would check into your credit score/report and then consider a credit card (that you pay in full each month) as a tool to build up a better score.

Thanks for stopping by with a great question, and good luck with your repayment!

Bryan

Thomas,

Thanks for all the information, really helpful stuff. I just have a quick question regarding how paying off my student loans in full will effect my credit score in the long run. If I pay off my student loans in full, would it bring my credit score up the same amount as making the monthly payments over several years? For example, I have 15k in student loans, say I made the monthly payments till I paid it off and my credit score went up 75 points. If I paid it off in full right now, would my credit score still go up close to 75 points? Its really confusing to me so I hope you understand my question. Thanks!

Thomas Bright

Hi Bryan,

You are right that the age of your accounts can affect your credit score, but that’s typically only true for revolving accounts (like credit cards). With installment loans, paying them down to zero doesn’t mean that they will be closed and bring down the age of your accounts. In other words, your credit score shouldn’t take a hit if you go ahead and pay that off. In fact, there’s even a chance that you could see a significant score increase as a result of decreasing your debt to income ratio.

Best of luck!

Chris Dye

I have a question about paying off student loan debt…

I owe 10k, but I have had some missteps along the way and have some missed/late payments.. My question is should i pay the whole thing off now that i can or still pay monthly to get a good payment history?

Im just trying to doing everything i can to boost my credit score so i can buy a house.

Thanks

Thomas Bright

Chris, it may depend how late the payments are. Were they reported to the credit bureaus? You may be able to work to get some of these removed (by writing the servicer) but also, know that an occasional 30-day or 60-day late mark might not have a major negative impact on your credit (see this article: http://www.credit.com/credit-reports/late-payment-secrets-revealed/). It sounds like getting up to date on payments and making on-time payments moving forward will be the best bet for you.

Matt

Working for a non-profit hospital, my hope is to have my federal loans forgiven after 10 years of paying on them. Is there any benefit to paying them off earlier (6-9 years)? Paying them off earlier would also result in me not being able to contribute to my retirement plan/IRA. Any guidance is appreciated.

Thomas Bright

Ah, that’s a really good question. The loan forgiveness program is a great resource for many people. If you’re on a 10-year repayment plan and make all your payments, then it won’t have any impact, but it’s great for those who have their loans on some sort of extended plan (beyond 10 years) or those who are having difficulty. When we factor in retirement, there are a lot of numbers to crunch and it can get confusing, so I’ll keep the advice simple:

If your student loans have average interest rates (think: 6-8 percent or below) then you have a great chance of getting equal or better returns in your retirement investments, plus you might get an employer match if that’s offered. Because of that, repaying the loans at the minimum monthly payment amount and then saving for retirement is likely best.

The one kicker is that if you do rely on the forgiveness program, you need to be certain of your career and stay with your job (or another qualifying job) for the total 10-year period. Switching gears and leaving the nonprofit sector might make repayment much more difficult.

Best of luck!

serf

I consolidated my loans with my husbands in 2004 – total loan amount was about $45K, about 5% interest, federal (not private). I’ve been paying $405/month since and have paid back a total of about $45K. I looked into how much I would have to pay, to pay back the loan in full, and the student loan service is saying my pay-off amount is $60K! How could that be possible? I know I have accumulated interest over the past 10 years, but the $60K must include future interest – why would I have to still pay future interest if I’m paying it off now??

Thomas Bright

Using this student loan calculator, on a standard 10-year plan, you would have needed to pay about $477/month and would have paid about $57K over the life of the loan. Since you’ve paid slightly less each month at $405, it makes sense that your total would be a little higher at $60K.

By future interest, it’s probably just accounting for the interest that is growing between now and when you make your last payment. Student loans accrue interest every single day.

Hope this is helpful. And good luck to you–you have come a long way and don’t have much further to go! Nice job!

Pat

Hi! And thank you so much for taking time to help me. I’ve had this dilema for the past couple months. i have 2 fixed federal loans at $34k and $60k with interest rates at 5.12%. My monthly payment is $560 total for both loans. I also recently sold a rental property and profitted $100k. Combined that with my current emergency fund of $40k, i have $140k in total “savings”. My annual income is $180k. Is it better off using my savings and paying off at least one of the loans or find other ways to invest my current savings? Appreciate the help! Thanks!

Thomas Bright

Hi Pat, that sounds like a good problem to have! I don’t want to give a specific answer, because there are so many factors involved. Paying off the loans would bring peace of mind, but 5.12% interest is fairly low and you can likely make a better return on other investments. You might want to seek the advice of a financial advisor, or someone who can provide realistic expectations in regards to your potential savings/investments, as that will play a key role in your decision. You’ll also need to consider other debts you might have, such as a mortgage. Good luck!

Hanna

Hi there and thank you for taking the time to help all of us!

I am broke. Like broke broke. I’ve been trying to making extra payments. I’m currently on a $50 a month repayment plan and have been making an additional $60 payment each month, because even though I only make a few hundred dollars a month I just want this loan paid off and gone so I don’t have to pay as much interest long term. I would like to be able to buy a car (mine is really really old) and find a place to live (so I don’t need to be living in my parent’s home) and have at least a small emergency fund of $500 or so, but to be honest the idea of not paying ahead is sad. I only owe another $3,150 on the loan with 3.4% interest. I’d just like it gone so I can feel like I have less stress and more money freed up so I don’t have to think about paying MORE money on interest. Any thoughts?

Thank you =)

Kris

I have about $29K in student loan debt, and all are subsidized and unsubsidized federal loans. My extended family has a trust fund, though we only use it to borrow against and pay back. My father offered to use the trust to pay off the student loans, and have me make monthly payments to the trust at a very low interest rate (1%-2%) as an alternative. I am concerned about doing this arrangement, however, as I would lose out on the student loan interest tax deduction. I know this arrangement would save on the interest I would pay for the federal loans, though is it enough to offset the tax deduction? Any thoughts?

Thomas Bright

In my opinion, this arrangement is probably the better way to go from a math perspective. The tax deduction isn’t worth chasing, and it sounds like those really low interest rates to the trust fund won’t have much effect. The real issue here is whether you are comfortable with any tension or pressure that might arise from borrowing money from family. That’s an answer only you can determine. Whatever you choose, good luck!

Dave

I just paid in full $39k in federal, private and credits cards over night after a large bonus check at work.

My question is… will this increase my credit score significantly? And how long? Also, I had a loan forgiven. Does that change my credit at all?

Thomas Bright

That must be a nice bonus! You should definitely begin to see some improvement to your credit score, assuming you didn’t close the credit accounts once they were paid off. As soon as these lenders and creditors report your new statuses to the bureaus, you should be all set. As for the forgiven debt, that will be reported in a way that’s less favorable, but hopefully the good progress you’ve made will significantly overshadow that. Good luck!

dave

school** ^^^ lol. as you can see my education paid off!

Thomas Bright

Hahaha, no worries. At least you caught your own typo 🙂

dave

I graduated with my bachelor’s degree last August 2013. I finished scool with a little over 42k in loans. I now have paid them off to the point to where I owe 21k and some change. It feels so good to have some of the burden lifted off my shoulders. I am fortunate enough to still have an emergency buffer in savings in case something happens. I’m 26 now and have a goal in mind to have all my student loan debt paid off before i’m 28 years of age. I can feel the stress and burden being lifted as we speak!!!

Thomas Bright

That’s a really incredible story, Dave. Keep up the great work and financial discipline. You’ve already come a long way in a short time, and I bet you will finish your goal. Best of luck!

Brittany

I originally had $70,000 in student loan debt when I graduated in August 2012. I have gotten my principal balance down to $55,000 as of right now and I have a great job as a mechanical engineer. I am 24 years old and I am renting an apartment but I am at the point in my life where I am tired of renting already and I want to start saving for a house. I have managed to save up 3 months living expenses as a security blanket and I have been putting any extra money towards my student loans. I have a 401K plan started and I currently contribute the maximum that my employer will match. Now I have to decide what to do with any extra money I have, do I put it towards extra payments on my student loans, extra money to my 401K, or save it for a down payment on a house? I want to put it towards the house but i’m not sure if that is the smarted choice. Like I said, i’m only 24 so I have a little time but what would the best financial plan be? I have 0 credit card debt, the only other debt I have is a car loan and that will be paid off in two months. Do you have any advice on what would be the best way for me to use my money now?

Thomas Bright

Hey Brittany,

Thanks again for your question. You might have missed my answer the first time around, but it’s here in response to your other comment. Thanks again for reading and asking a question that is probably on a lot of people’s minds!

justin

also heard and read that after 120 payments it will be forgiven. i am planning on trying to contact the servicers.

Thomas Bright

Yep, it depends on which program you qualify for. There are some based on occupation and some based on income, and the rules are different for each.

justin

i have about 62k (sub and unsub) in student loans my goal is to pay it off within 10 yrs. or less if possible, but I keep hearing that i should just pay the min and let the rest be forgiven after the 20/25yr life of the loan. what the negatives of doing this?

I have an ed degree and am deciding on jobs. one will allow to stay at home and a bit more towards it, but a little extra stress since i will then have to go through the hoops again to become certified in this state while i teach. the other i will be on my own but money may be a bit tighter, still will be able to pay my planned amount of about at least $700/month.

Thomas Bright

Hey Justin,

Well you have to qualifying for a program that allows for forgiveness first (such as the income-based repayment plan). Or, if you are a teacher and can get qualified for PSLF, you can have the debt forgiven after 10 years. To me, the downsides of all this are that A) you could have a change in your situation that later makes you ineligible for forgiveness (such as not being a teacher anymore) or B) that you could hurt your credit by not paying more toward your loans. B. wont really be an issue as long as you make the minimum payments for whatever program you are int. My best advice is to find a program that offers a monthly payment you can make comfortable while also limiting interest growth as much as possible. From there, I suggest doing your best to be proactive in repayment so that you can contribute to other life goals like buying a home and saving for retirement. Good luck!

Alvin

Hello!

I am trying to determine whether it would be best for my credit score/minimizing interest if I…

1) Pay the loan down very low, maybe to ~$100 or so and then let it stay open until 2020 (or as long as I can stand it) and pay it off at the last minute to maximize the account length & maintain credit type diversity

OR

2) If I should just pay off the loan completely right now and be done with it.

Thank you!

Thomas Bright

Alvin,

I typically recommend that you pay it off as soon as possible. If you’ve been on time with your payments, then you have already gotten some good improvement to your credit score (more than likely). Installment loans don’t work like revolving accounts in the way they are factored into your score. Creditors know that installment loans are meant to be paid off, so you don’t really lose anything by closing them early. Credit accounts are different, and length of the account can play a much bigger role. Hope that makes sense!

Brittany

I am not sure what is best for me.. I graduated college with $60,000 in student loan debt (private school with an engineering degree). I make good money and I already contribute to my 401K up to what my employer will match. I also have 6 months living expenses saved up and I have just started a new savings account for a down payment on a house. I just turned 24 but now I don’t know what is the smarter choice, do I put more money towards my savings account for the house or towards paying my student loan debt down? I have almost been out of school for 2 years and I have paid off all of the interest on my student loan to date as well as an additional $8,000 by making extra payments. I have no credit card debt and the only other debt I have is a car payment that will be paid off by the end of the year. Should I keep making extra payments towards my student loan or should I put more away for a down payment on a house so I no longer have to rent an apartment?!

Any advice would be really appreciated!

Thomas Bright

Great questions Brittany!

As someone who just bought a house, I have some advice for you! Saving for a down payment is a great idea. Ideally, you’d want to have enough to avoid Private Mortgage Insurance, which can be even $70 or so each month (which totals $4,200 after five years). You’ll need a 20 percent down payment to avoid this in most cases. At the same time, though, you need to weigh this goal against the level of interest your student loans are accumulating. For instance, if you had a $50,000 student loan at 6.8% interest, guess how much interest you will pay after 5 years of minimum payments–almost $14,000. My point is this: mortgage rates are low and even PMI can be much less painful than the interest that will add up on your student loans. My opinion is that you should save up for a down payment, but not put too much pressure on yourself to save a full 20 percent. You might be able to pay down your loans aggressively and still save for a decent down payment (maybe 10 percent). A “middle ground” strategy like that might be great for someone in your situation. You will minimize the interest you pay to your loans (which is essentially wasted money) and be able to get out of paying rent (which might also feel like wasted money). Maybe this comes with the sacrifice of paying PMI, but that might be cheaper than your alternatives, especially if home prices are expected to rise in your area in the next few years.

Good luck!

Bruce

I have almost the exact amount of money it would take to pay off my loan. I am in the military so I have a paycheck coming no matter what. I also have a rainy day fund and emergency account but I just don’t know if I should pay it off now or just increase the amount I’m paying any help would be greatly appreciated.

Thomas Bright

If you have an emergency fund, it sounds like a great idea. As long as you dont have other high-interest debt (like credit cards) or an important financial goal you are working toward (like a house downpayment) then I say go for it.

aloha

A student loan is a loan if you have 6 percent interest with a 10 year payment plan paying early should mean the same thing as paying a loan back the next day you took it out, You have the money your all paid up only previously accrued interest due to the time it took you to pay back should be added. If they are saying that it doesn’t matter how early you pay back your responsible to pay all 10 years worth of interest about 33% more than the loan value then its not a loan its more like a straight up fee since they are not basing it off time anymore and you should be allowed to hold onto your money and invest it till its due 10 years down the road not not in increments. It sounds like a joke if they are saying you can not pay your loan off early its like saying if you wanted to open up another loan to transfer out of it that the new loan would have to be opened up at the amount owed+interest and then have to start charging you more interest on the new amount that should be illegal since the interest clearly states its 6% annual interest, so each year they get to charge you 6% not 33% fee in 10 year increments.

Andrew

For my earlier comment, it is through FedLoan

Andrew

Hi,

I have a 56k student loan debt. It is across 7 loans, most being about 5k each with 3.4% a couple at 8k and 10k with 6.4% and one at 20k with 6.4%. I recently am now able to pay off 31k of it. Will my monthly payments be lowered if I pay off some of these? What is the best way to pay off? The largest one with the highest interest rate first? or the numerous smaller ones first? My current payments are $650 a month and they are pretty hard to make.

Thanks

Thomas Bright

Good question Andrew!

I’m glad that you are able to put such a big dent in these. I would advocate for putting the money to the loans with 6.4% interest rates. You might want to knock out the 20K one first and then the 10K. that should bring your monthly payments down significantly while also limiting how much interest you will pay over time.

Since you will be knocking out more than half of your total student loans, you will probably see your monthly payment cut in half too (or close to it).

michelle

Hi!

I have been paying $50 of my interest for about 1 year now. My grace period ends in June. I realized that my interest in 1k and my principle is 27k. I am wondering(since I have the funds) if it would be possible to pay off my interest entirely so that all I have left would be to pay off my principle loan? I’m not sure if thats exactly how student loans work and if I would still acquire interest after I have paid it off? I’m just confused and wondering would be the wisest plan since I would like to start paying off my principle amount after my grace period ends.

Thank you!

Thomas Bright

Michelle,

You should definitely read our post on The Best Way to Pay off Student Loans if you haven’t already. I think that will answer some of your questions.

Student loans accrue interest every day, so you will have more interest to pay even once the $1,000 is gone. You will need to knock out that $1,000 in order to make real progress into your principal.

good luck,

Thomas

Biki

Hi ,

I have a student loan of about 12K at interest rate of 6.9%.

I secured a cash loan from a local credit union (10k) at 3.49%. I am planning to use the cash loan to pay part of my student since it has a higher interest rate.

Do you think this is a wise thing to do?

Thomas Bright

I see where that is a good idea on the surface. I guess the bad news is that you will now have two loans with two lenders, since the cash loan doesn’t cover the entire balance. What happens if you cant finish off the student loan? Now you owe multiple people. Also, is the student loan federal? Or, does it have any unique benefits or safety nets? Those may be things that the credit union loan doesn’t offer. That’s a tough decision you have to weigh. One idea might be to get the student loan down to 10k first and then move forward with the plan.

Leon

Hi,

I am lucky to have a great job, and I just made my last student loan payment in Feb 2014. I have not done anything else differently. Today I notice my FICO score has gone down from 839 (Feb-Mar) to 799 (Mar-Apr). Does paying off my student loan affect my FICO score ? Thanks for your time

Thomas Bright

Hi Leon,

You will sometimes hear people say that carrying a small balance is better for your credit than having a zero balance. But, as a rule, this advice applies primarily to credit cards. Similarly, you will hear that “closing an account” can bring down your credit. But again, this is for credit cards. Installment loans like student loans are meant to be paid off eventually, so you did the right thing! You would not anticipate a big swing in your score like that. Granted, you might have taken away the diversity of your accounts, etc. but again that shouldn’t make such a huge difference. I would pull a copy of your credit report just to be safe and see what’s going on. also, make sure the two credit scores you are comparing aren’t apples and oranges. Both need to be the same FICO score from the same bureau. Believe it or not, your Experian FICO score and your TransUnion FICO score can be very different.

Hope that helps!

Thomas

marc

Do federal/private educational loans offer any benefits if you pay off loans in full?

Thomas Bright

Well as far as I know the only benefit is that you don’t have to pay interest and sacrifice your peace of mind. But seriously, no–I have never heard of any discount or other “perk” associated with paying them off in full.

Lauren

Hi – I want to know if it is a good idea to pay the interest as it accrues plus a little more that should be applied to the principle. My payments are not due yet (since I’m still in school) and won’t be for another year, however I want to avoid having to pay interest on interest.

Thomas Bright

Sounds like a good idea to me. The lower you can get the princiapl, the less interest you will pay. But you really want to prioritize the loans with the highest interest rates. Check out our article called “The Best Way to Pay off Student Loans” to learn more about how to approach this. Good luck!

Matt

I am a student at a small private school in Ohio. I will be graduating in May with a Bachelors, Master’s and 15k in debt. I am currently a staff accountant at a public accounting firm making 31k a year (take-home: after taxes and $300/month retirement taken out). Plausibly, I could pay off my 15k loans in a single payment upon graduation. What is your opinion on this? I already have a decent credit score (756) and am currently living at home by choice while I am still in school so I have few expenses. Should I pay off the loan all at once, over a year, or something else?

Thomas Bright

Matt,

If it was me, I would pay it off all at once like you said. There would be just a few things I would consider. Do I want to buy a house now or in the next 2 years? Do I need a bigger emergency fund set aside? If you answer yes to one of these then you may want to hold on to some of that savings. Otherwise, pay off the loans and enjoy peace of mind. Best of luck!

AD

If you Itemize your taxes and your student loan interest tax deduction is less than $500 per year, I think paying off the loan would be a good idea. Use some of your monthly savings to buy new clothes, then donate some of your old ones. You can get your equivalent tax deduction of $500 without raising any IRS flags 🙂

Thomas Bright

Thanks for commenting. Tax implications of student loans can sometimes play a factor. But I can’t really think of a case where it would be better to not pay one off in order to deduct negligible interest growth.

Nate

Where can I go to consolidate my student loans and will they consolidate mine with my wife’s? Thanks

Thomas Bright

Hi Nate,

There are tons of financial institutions that offer loan consolidation. Start with your own bank or credit union and then use the Internet to research others. It’s important to compare rates and terms along the way. And no, unfortunately I don’t think you will be able to consolidate you and your wife’s loans together. This used to be possible but was repealed in 2006.

Good luck in your repayment.

sarah

Am not far off from being able to pay off my college loan. Currently have an opportunity due to new management at my work, to place money into an IRA or take it for myself with taxes being deducted. Does it make sense to take the money and put it toward paying off my college loan or roll it over to an IRA?

Thomas Bright

You know, that really depends on the interest rate of the loan. If it’s a private loan with a super-high interest rate, you might consider paying it. Otherwise (since your student loan is close to being paid off anyways), it probably makes more sense in the long-term to go ahead and make the IRA contribution. I can’t say for sure without knowing a lot of specifics, but because IRAs rely on compound interest, the earlier you contribute, the better. By making that contribution you will probably be creating more money for yourself in the future than you will save on your student loan. Hope that makes sense!

Bria

Hi, I am really stressing out about totally paying off my student loan, I have no other debt besides this one. I want to know if it’s a good idea to totally pay it off I have worked hard to save this money to get out of debt. I will use all of my savings to do so but I will get a good return on my taxes. I’m torn to keep this money and continue to pay minimum and pay out much more over my lifetime or get this burden out my way ? Any suggestions

Thomas Bright

Hey Bria,

Don’t stretch yourself too thin. Make sure you keep an emergency fund handy. You can put the rest toward your student loan, though. Or you might consider contributing some to an IRA or 401(k). Good luck!

EEfigenio

After viewing my loan which was about 28k, I realized that after grace period was over I realized that I already had over 1k in interest(unsubsidized loans). After this I decided that I would pay them all off before a year is up, my first payment was 20k, and now Ill use bonuses and income tax to pay it off. It actually feels real good, and if you can do it I recommend it.

Thomas Bright

Wow that’s an awesome story! good for you for having that much money saved and for making your student loans a priority. Burden–lifted! Nice job!

Andrew

The only situation which I would personally recommend paying off student loans early is if there is no other debt to take care of. Student loan interest is tax deductible. Credit card interest is not. Once you factor in that fact, does it really make sense to pay off your loan early if you have any other lines of credit for which the tax is not deductible?

Thomas Bright

Andrew, fantastic point. No, that would not make sense and the tax deduction isn’t even the main reason. Consider interest rates. On credit cards, these can be 18% or higher. For federal loans, we’re typically talking about something around 6.8%. It totally makes sense to focus on credit card or other high interest debt if you have it. Thanks for the comment.

Julie

If i wanted to pay off my school loan outright would they give me a discount for doing so?? for instance sometimes with doctors bills they give you a discount if you can pay it in full….just wondering if its worth a phone call to ask them

Thomas Bright

Hey Julie,

I’m doubtful that they would do anything like that, but it’s certainly worth a phone call to find out. It can’t hurt to ask, right? If by some chance you do get a discount, please come back and let us know!

Good luck!

James

I have a question regarding paying off early vs paying the minimum requirement. Do any of these two affect your credit score more positively than the other?

Thomas Bright

James, this is a great question!

Let’s review quickly how a credit score is calculated according to FICO: Payment History – 35% Amount Owed – 30% Length of Credit History – 15% New Credit – 10% Types of Credit Used – 10%

Based on this, we can see that by paying your loans earlier, we can decrease the amount we owe while also having a positive payment history. On top of this, we will still have a “long” credit history, because paying ahead does not mean paying over night. It still takes time. Because of these factors, I think it’s pretty safe to say that in most cases paying off your student loans early (more than the minimum) will benefit your credit score significantly.

Thanks for the great question!

Joseph

I think it’s a great idea to payoff student loans as soon as possible. The savings on interest allows you to invest that extra cash into your 401k or Roth IRA. When you consider the growth potential in a retirement account, the value of the cost savings is so much greater than the original $2,584.18!

Thomas Bright

Great point Joseph,

I guess the counterargument is that by not paying off your student loans early you can save for retirement earlier, which can help in terms of compound interest. Both sides have good points, but I’m with you on this one!

Thanks for reading and commenting!

hammerman

Yeah this is a decent way of looking at it…if that’s how your student loans work…

I paid ahead about 6 months but only about 1/3 went to my principal where the reminder 2/3 went to interest…strange since the only outstanding interest at that time would of been covered…

After calling the company they said they apply it to future payments and future interest. WHAT!?!?

Basically unless all the interest estimated for the entire loan from start to finish approximated over 15 years is paid off; more money wont go to your principal, they just use the left over money to future payments.

Thomas Bright

Good point Joey,

The policy will vary by servicer. It’s always best to call first and make sure the payments will be applied like you want. Sorry that happened to you! Thanks for reading and sharing that point!