Will You Be Tracking Your Expenses in 2015?

2015 is a year of new challenges, new opportunities and new reasons to keep a closer eye on our budgets. As the nation’s economy continues to improve, it becomes increasingly tempting to spend money, knowing that we have job and income security that may have been lacking just a few years ago. It’s important to remember that we need to keep our spending in check and budget for all of our purchases, both big and small. Doing so will allow us to acquire plenty of “wants” in 2015, while also meeting our needs and saving money for our futures. And of course, a goal like this should become a lifelong habit—not just a short-lived New Year’s resolution!

What to Track

If you haven’t done detailed tracking before, you’ll want to be sure to include everything. After all, forgetting categories in your budget can lead to real confusion, and you may end up thinking you have more money than you really do. The easiest items to remember are the big ones—things like your mortgage or rent, utilities, car payments and monthly bills (like any credit card, student loan or medical debt, plus things like insurance).

Then there are plenty of smaller items. Groceries, clothing, meals out, haircuts, pet supplies, newspaper subscriptions, gym memberships and stamps are just a few of the expenses that can be easy to overlook when trying to plan for a month.

For some of these, you probably already know what you spend each month. But for others, you may not be sure and it might even change frequently. There might be some items that you only purchase once every other month, or even every six months. But you can (and should) average out these costs to determine a monthly total. The important thing is to understand that you are putting something toward the costs each month, and so they need to be worked into your tracking system. If you have a hard time anticipating costs, then another idea is to keep all of your receipts for one month and then go back to make a record of how much you spent on various items.

How Much to Spend

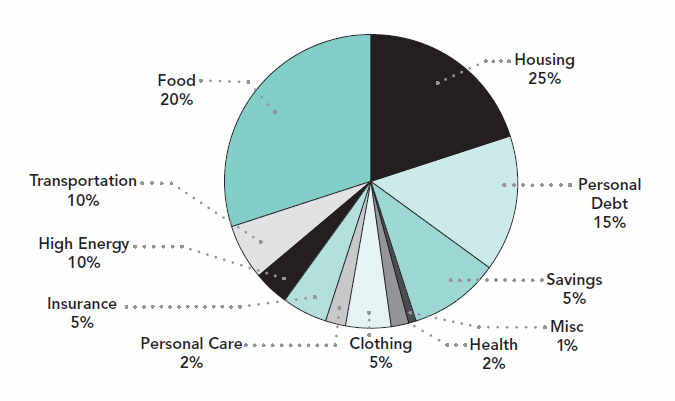

So you can track spending, but how do you evaluate it? What should be your goals for how much money you are allotting to different categories? Here is how we recommend divvying up your budget:

A few notes: There are just a few things worth mentioning about the chart. First, “High energy” refers to utility costs. Secondly, 15 percent is the upper limit we recommend for debt each month. It’s “ideal” to be debt free, but we feel as though it’s generally safe to have a debt-to-income ratio of up to 15 percent. You can read more about achieving a good debt to income ratio.

Try Our Convenient Tool

One of the biggest barriers to creating a budget and tracking expenses is staying organized and finding a convenient method that works for you. Luckily, we’ve developed the “Build a Budget Calculator” which makes this much easier. The tool allows you to track your income and expenses and see how much of a deficit or surplus you have each month.

Check out the budget calculator now (it’s mobile-friendly, so feel free to take it on the go). And consider pairing it with our Pocket Tracker and Debt Payoff Table for even more budgeting success! If there’s anything else we can do to help with your finances, let us know. Our nonprofit counselors would be happy to work with you in a free credit counseling session.

Comments

Leave feedback or ask a question.

No responses to “Will You Be Tracking Your Expenses in 2015?”