How Should I Use my Tax Refund? What’s the Best Way?

If you’re like most people, then you are probably getting a tax refund this year. In fact, CNN Money claims that almost 80 percent of tax filers will receive money rather than owe it come April 15. While this means that you’ve actually been overpaying the government over the course of the year, you’re probably excited to have the lump sum coming in. But how will you spend it? Here at Clearpoint, we frequently hear stories of clients using their tax refund to take vacations or purchase new items (TVs, cars, gadgets, etc.). Essentially, these are “wants,” and purchasing them doesn’t use your refund to its true potential. Today we want to talk about the ideal way to use your tax refund from a perspective of long-term financial efficiency.

Rethinking the Concept of a Tax Refund

The first thing you need to do is establish what a tax refund really is. No sugar coating here—a tax refund represents money you’ve been unnecessarily giving to the government. Now there might be a few exceptions here, particularly tax fluctuations that can’t simply be controlled by changing your withholding (tax credits for things like having a baby etc.). But for the majority of us who get a refund, we are overpaying. What’s worse is that we are taking money that could either grow or serve as a savings cushion and we are handing it over to someone else who doesn’t allow it to grow at all.

If we kept the money ourselves, we could invest it either in short- to medium-term investments or toward our retirement. Or, if we weren’t quite ready for that commitment, we could keep the money on hand as part of our emergency savings, so that we’d be prepared for the unexpected and wouldn’t face extra pressure to take on new debt when, say, our car breaks down.

But since most of us don’t use this approach, we are left with this reality: our tax refund is a zero-interest savings account. Now, while that certainly hasn’t been the optimal use of our money, it’s not the end of the world. And for some of us, it might even remove the temptation of spending it throughout the year. That said, now that we are receiving it in a lump sum as a check, we need to remember that it’s money we’ve been setting aside all year, not “free money” or something we’ve forgotten about. When it’s thought of in that way, we tend not to make the best use of it.

Deciding How to Use the Refund

Once you make the commitment to use the refund efficiently and as a tool to improve your overall financial situation, you need to determine the best place for it, which will depend on a few specifics.

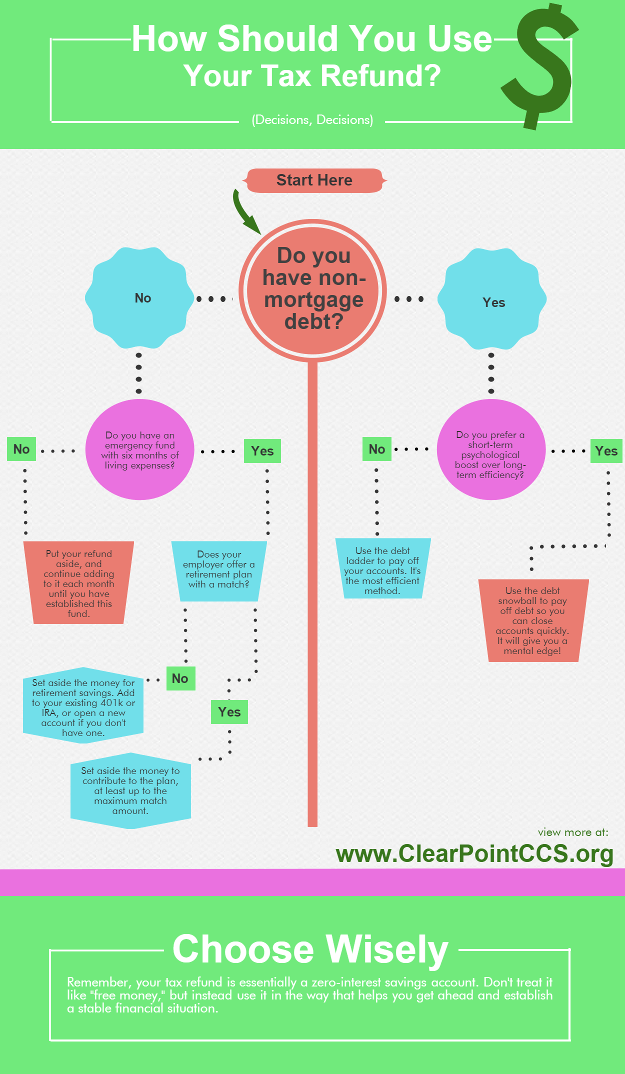

But the biggest, most important question to ask yourself is whether you have non-mortgage debt. Determining this will help you decide whether to save the money for your future or use it to pay down a high-interest account that is holding you back. (Be sure to see our caveat below the infographic). It you’re lucky to have zero non-mortgage debt, then you will also want to ensure that you have an emergency fund of six months’ living expenses, and the refund may help establish the fund.

Once you establish these initial points, the rest of your thought process may look something like the chart below. Of course, this is just an example and our best attempt to show how you should spend the refund, and your individual situation may warrant a slightly different approach. Still, this should be a good start.

A few caveats

One point worth noting about this approach is the way we’ve defined non-mortgage debt. In reality, all non-mortgage debts aren’t created equal, and your situation might lead you to a different process.

The real factor you need to consider is the interest rate of your accounts (we’ve talked before about interest rates and efficiency). If your interest rates are low enough to the point that you can expect better returns from investing, then it might make sense to invest and then pay the minimum payments on the debts. This will most likely be true for consumers with student loans (particularly federal loans) and those with good credit who have low interest loans, like auto loans. Still, paying off the debt will never be a bad thing, and should be an approach you consider strongly.

If the Refund Doesn’t Cover It

If you have non-mortgage debt and the refund doesn’t cover your accounts, you’ll want to make sure that you have a solid plan for managing your money moving forward. As much as possible, you will want to put money toward the account(s) so you can eventually be debt free. Maybe that goal isn’t far off, or maybe it feels like you have a long way to go. Either way, our counselors can review your financial situation and make recommendations about how you can increase income, decrease spending and make a plan to improve your financial future. Learn more about our free budget and credit counseling program.

Correy Smith

Wow, what a great a way to learn about how to use a tax return straight from an illustration chart. I remember having to learn about this after high school and how it took some time for me to learn about it. I’m pretty sure that’s how everyone who have done their tax returns have felt like that.

Thomas Bright

Absolutely! Thanks for the feedback and for reading!