Refinancing Student Loans: Who Should Do It

Refinancing student loans is a tempting option for many borrowers in repayment. It brings the promise of lower payments, and most people assume this will make for an easier repayment. There are some reasons to use caution before jumping into this decision, though. While new terms may look better on paper, they could potentially cost you more in the long-term due to interest. Refinancing also isn’t a good idea for everyone, and its effectiveness can vary based upon your past and present credit scores. And, like with all student loan issues, the differences between refinancing private student loans and public student loans are significant.

The Idea behind Refinancing Private Student Loans

The most common form of refinancing student loans for private loans happens in the form of consolidation.

The idea is this: replace a student loan, or multiple student loans, with a new loan at a lower interest rate.

This can be done by reaching out to your lender and requesting this option or by reaching out to another lender who offers student loan refinancing. Finaid has put together a great list of private lenders who offer student loan refinancing. This new lender will essentially take over your debt from the original lender. Before you do this, read our post on how to pay off private student loans and consider reaching out to your lender directly to discuss other options.

Refinancing student loans typically has one of these benefits:

- Reduced interest rate(s) to save you money during repayment (be sure not to switch from a fixed rate to a more dangerous “variable” interest rate)

- Reduced monthly payments to prevent you from defaulting (although this will make repayment longer and costlier)

- The convenience of one monthly payment

It’s important to identify what your needs are before moving forward with refinancing student loans. The best benefit is to receive lower interest rates, but this won’t be possible for everyone.

Refinancing Student Loans When Your Credit Score Recovers

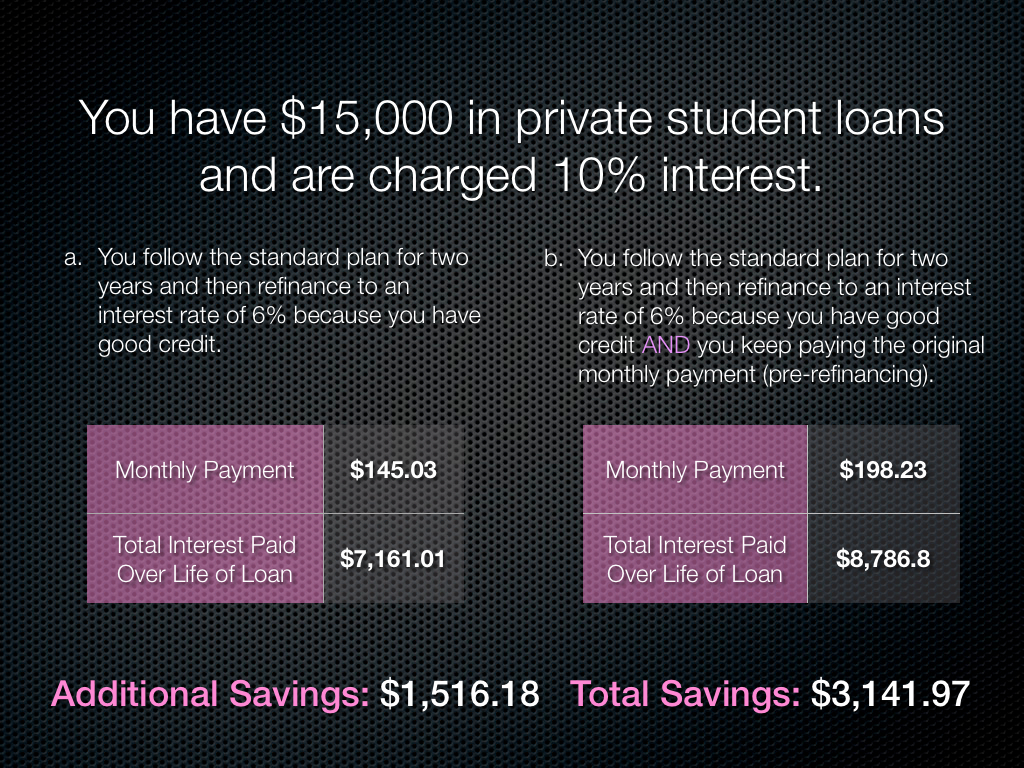

As we pointed out, the key here is to secure a lower interest rate, which will in turn save you thousands of dollars over the course of repayment. This is far more helpful than just a reduction in the monthly payment. Lower monthly payments are easier to make, but they also make total repayment take longer. Take a look at this example:

Lower interest rates beat lower monthly payments any day. So, who is eligible to refinance for lower interest rates?

This is where the credit score comes into play. If you have improved your credit score since you first applied for the loan, chances are you can negotiate a lower interest rate, either with your lender or a new lender. The change in interest rate will likely be determined by how much your credit score has improved.

Let’s assume that a private loan borrower has $15,000 worth of loans at 10% interest. They have been paying these for two years and have decided to refinance with a new interest rate of 6%. Here are the savings:

By refinancing these private student loans, the borrower was able to save $1,625.79. Upon consolidation, a new 10-year repayment term began. So, the total repayment time climbed from 10 years to 12 years, but the savings were still significant.

Now, let’s assume the borrower was having no problem making the original monthly payment of $198.23 and wants to continue paying this amount even after refinancing. This would create more savings and a shorter payoff time. Take a look:

Refinancing Federal Student Loans

When it comes to refinancing, there are many differences between private and federal loans. Consolidation is just one of many options available to consumers who want to refinance federal student loans. And, it’s important to understand that consolidation isn’t always the best option.

Income-based repayment options and other plans could be much more beneficial to the consumer. If you rush into federal loan consolidation, you may lose the eligibility for some of these potentially better programs.

Also, federal borrowers should always keep one rule in mind: never consolidate federal loans with private loans. Very few lenders even offer this option, but it is possible. Doing this will strip away some of the benefits available for your federal loans, as they will basically become private loans in this process.

Exploring Your Refinancing Options

In some cases refinancing student loans is a great idea. As we have shown, the savings can be significant. But before moving forward, it may be a good idea to get some professional advice.

To sort all of this out and make the best decision for refinancing student loans (especially federal loans), sign up for student loan counseling. A no-cost session can help you make sense of your options. Call 1-800-675-7601 or click here to get started.

Shannon

I started with 55k in private loans when i got out of school. No one told me that going the private route was a really bad idea here i am 10 years later with 47K still to pay back.

My loans were bought and sold to so many venders it made it very hard to follow the paper trail. My monthly payment was $477 i would pay $577 to $600 a month for 9 years and the way in which the companies disrupted my money between interest and principle was criminal. I was locked in at a fixed 8.9% interest rate which is super high but making it work, before moving to a variable interest rate i paid in 9 years only 5K of that loan. You tell me how thats possible?

Here i am 33yrs old, 10 yrs deep into my loan which should be next to nothing in terms of what id be paying monthly had i not be screwed by the companies that shuffled my loan around. Im currently on a variable interest rate of 4% i noticed you said that was not a good idea, however for me its been much better than the previous loan lenders. What should i keep an eye out for in terms of companies that offer low interest rates for private loans, is there even such a thing?

Desperately needing some help

-Shannon

Thomas Bright

Wow sorry to hear that Shannon! It sounds like maybe the monthly payments were a bit too low for you to really make fast progress against the debt. I think that’s the biggest issue with a low interest rate — if the payments are too low so might still spin your wheels. Variable interest rates can certainly work, a 4% is pretty good. You just need to be careful and be fully aware of when it will climb back up again.