Debt and Marriage – How Paying it off Makes you Happier

If you are married, you may already know that debt and marriage sometimes have a rocky relationship. Money can be a sore spot in marriage if couples don’t take the right steps toward paying off debt. As one recent study shows, keeping your debt level low and avoiding materialism can put you and your loved one on the path to true, financially stable love. Clearpoint is here to show you how to pay off debt for a successful and happy marriage.

Why Paying Off Debt Leads to Happiness

In 2009, Jeffery Dew completed an important study with The Marriage Project. He explored the relationship between credit, debt, and happiness. Dew found that couples with healthy credit tend to be happier, and he concluded that “conflict over money matters is one of the most important problems in contemporary married life.” Specifically, unnecessary debt can wreak havoc on a relationship. One of the keys to a happy marriage, then, is to maintain a healthy debt level while minimizing unnecessary forms of debt.

Taking out new debt to buy an expensive car or a new HDTV is unnecessary. First of all, purchasing these items with credit makes them more expensive in the long-run because of interest. Also, these purchases create conflict if the two partners disagree. This really comes down to who is the spender and who is the saver in the relationship. Couples need to straighten this out before impulsively taking on more debt. Dew says that “decisions like whether to make a major purchase using consumer credit or how much of a paycheck to put into savings can have substantial consequences for the short-term and long-term health of a marriage.”

Easy Ways to Avoid Conflict

Disagreements over money can spiral out of control. Unfortunately, in some cases the arguing doesn’t stop with financial issues. Dew says that debt creates “unease” and “increases the chances that couples will argue over issues other than money and [decrease] the time they spend with one another.” Successful couples then will find a way to agree on which items are needs and which items are wants. By focusing on needs, couples will be able to budget effectively and put money aside for future purchases. These couples will be able to create an emergency fund (in case of unemployment or other unforeseen events) and will always have this available as a fall back plan.

An emergency fund doesn’t sound as glamorous as a new car, and it doesn’t have the technological sophistication of a hot new electronic. It does prepare couples for just about any financial situation. It also provides a foundation on which couples can build future savings and can even save up for that new car or electronic. Taking this approach might mean less material gain in the short-term. But, Dew reminds us that those who “steer clear of materialism and consumer debt are much more likely to enjoy connubial bliss.” Who knew bliss was as easy as saying “no” to credit?

Avoid the Conflict between Debt and Marriage altogether

Maybe you want to avoid the problems of debt in marriage altogether. Getting rid of debt before you get married is a daunting task. You may remember from our first blog in this series that the average age of entering a first marriage is 26.9 for women and 28.9 for men. And, average student loan debt for a recent graduate is about $26,600. Could you pay off over $20,000 in debt in five to six years? Yes, it is doable. Doing this would require thriftiness and an extreme commitment to your budget. It would also require a commitment to needs and a willingness to say “no” to some expensive activities (wants) like concerts, going out to eat regularly, and so on.

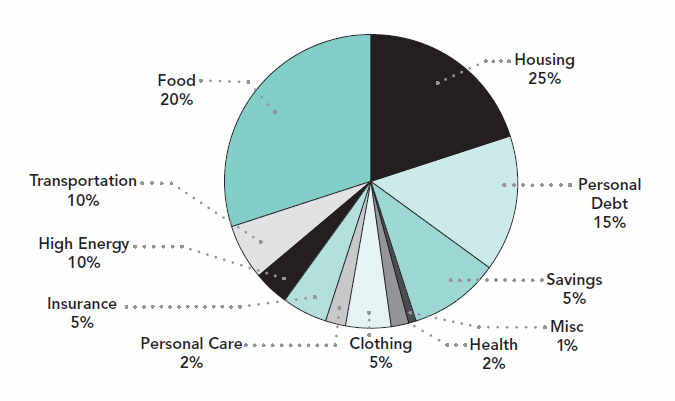

The average salary after graduation is $44,455 (expect lower if you studied humanities or social sciences). After 5 years, this amounts to $222,275. Paying off debt before marriage in this scenario would really only cost about 12% of your total income after five years. That’s totally doable. Take a look at what Clearpoint recommends as an ideal spending plan:

You also need to look at your debt to income ratio (if it’s over 20% you may need credit counseling), the growth potential of your income and job, and your long-term goals. Depending on the interest rates of your loans, it may be smart to make the minimum payments while also saving for retirement. If you have any high-interest student loans, those should be paid as soon as possible. We can’t give a blanket answer to the question of how to pay off debt before marriage, but you can find the answer that’s right for you by thoroughly investigating your finances. What we can say for sure, is that student loan debt can create a strain on relationships and makes women statistically less likely to marry.

Newlyweds can set their marriage up for success by either entering into marriage after their debts are paid or by paying them off early in the marriage. There is also hope for older married couples who may have some lingering debt. What’s important is to budget and separate needs and wants. Doing so will allow you to use extra money for savings and monthly payments toward credit cards, student loans, and other forms of debt. This will greatly increase your chances for a happy and financially successful relationship.

Free Help with Your Budget

If you aren’t sure of where you stand or just need some help, we are here. When you work with Clearpoint in a Budget and Credit Counseling session, you receive a free credit score, review your credit report and get a personalized action plan based on the specifics of your situation. The best news is that this is all offered for free! If this sounds like something you and/or your partner can benefit from, then get started today!